Newest COVID-19 relief bill helps college students

March 17, 2021

Congress passed the $1.9 trillion COVID-19 relief bill last week, in what many have described as the first significant piece of legislation to come from the Biden administration.

Among its contents, the bill allocates about $40 million for higher education and includes provision for financial aid and student loan debt forgiveness.

Here’s a look at what the newest COVID-19 relief bill, known as the American Rescue Plan, means for colleges, universities and their students:

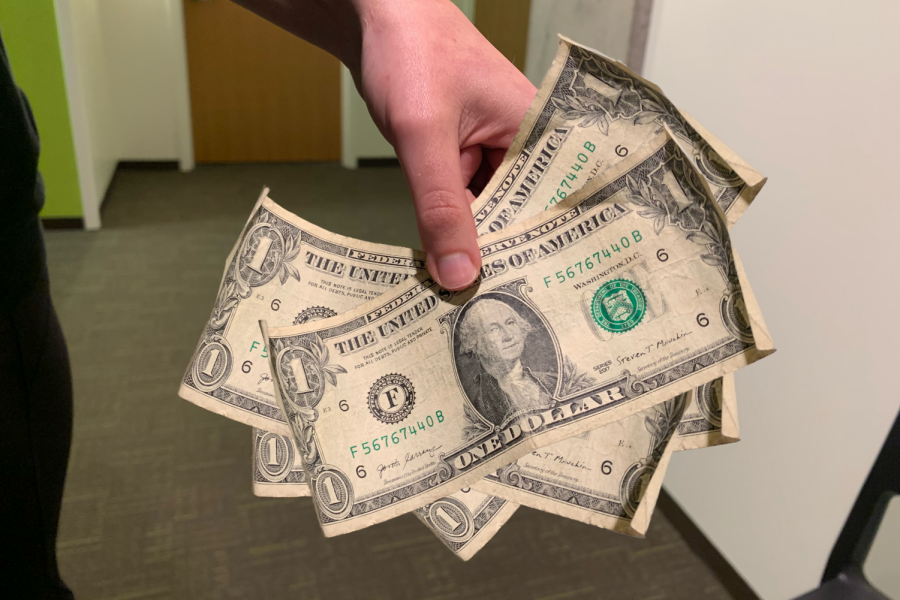

Direct payments now include adult dependents

Unlike the two previous versions of the stimulus bill, adult dependents are finally eligible for the $1,400 direct payment.

This means that college students and adult dependents who did not receive the first two payments, may be eligible for the payment this round. It is estimated that, under the CARES Act, as many as 15 million older children and adult tax dependents were ineligible for payments.

Still, the amount that adult dependents receive will depend on the income of the taxpayer who claims them. The current eligibility requirements are as follows:

- Single filer: $75,000.

- Married filers: $150,000.

- Heads of households: $112,500.

Payment amounts begin to phase out as the threshold is reached, meaning that the amount will drop proportionately to the taxpayer’s income.

This new eligibility will likely provide much needed relief to college students, especially to those who live and work on their own but are still claimed on their parents’ tax returns.

Senior Emily Cohen said the new eligibility will likely be really helpful for students who qualify.

“I know that a lot of students, like myself, participate in small jobs such as babysitting, but these jobs have been in low demand with COVID, so the stimulus checks are a great way to help college students,” Cohen said.

If you would like to check your eligibility or find out when you can expect to receive your check, you can use this IRS tool.

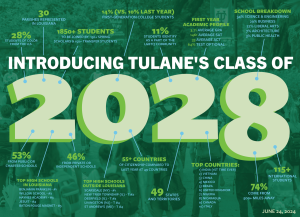

Half of education relief funds to go towards financial aid

The American Rescue Plan includes the highest allocation of COVID-19 relief funds to colleges and universities to date.

One stipulation of the bill is that at least 50% of the money each institution receives must go directly to students in the form of emergency financial aid. However, institutions still have discretion over which students receive aid. This aid may come in the form of tuition assistance, room and board or anything else that accompanies the cost of college.

Tax-free student loan forgiveness

The current moratorium on federal student loan payments ends Sept. 30, but the relief bill allocates $91 million to the Education Department to help prepare loan borrowers.

Also, under the Student Loan Tax Relief Bill, which became a part of the American Rescue Plan, any student debt that is forgiven by the government will not be taxable.

Currently, about one-third of the 45 million student loan borrowers are enrolled in programs called “income driven repayment plans.” Under these plans, a borrower’s repayment plan becomes more affordable because they are capped monthly based on a percentage of the borrower’s income. After 20 to 25 years, the remaining debt is canceled, but the loan amount forgiven is treated as taxable income which can lead to some hefty tax bills. Under the new plan, borrowers will be off the hook for these bills.

The provision will extend until 2025, but could become permanent. The inclusion of this provision marks a significant step for Democrats who want to cancel student debt.

Leave a Comment